The Indian insurance industry is one of the hard-core parts of the service sector. The economic scenario which emerged after the new economic policy has transitioned this sector into an open competitive sector. The IRDA allowed entry of global insurance players, only with their domestic partners and with a limit of 74% FDI cap. It not only provides safety against life risk for individuals but also acts as savings, financial intermediary, promoter of investment activities , stabilizer of financial markets which in turn leads to sustainable economic development. Moreover, the expanding scope of careers in the Insurance market has provided a plethora of job opportunities. Two day national seminar on the Insurance Sector in India-Opportunities and Challenges jointly organized by Department of Economics and Insurance Institute of India, Ernakulam was a productive one that provided the participants with an idea about the functioning of Indian insurance industry and its role in the socio-economic life of common man.

OBJECTIVES OF SEMINAR

- To give a picture to the participants about the functioning of the Indian insurance industry and its role in the socio-economic life of the common man.

- To analyze the post-COVID-19 scenario of the Indian insurance industry and strategy to improve the penetration and density of the Indian insurance sector.

- To get thorough knowledge about the job prospects of this prominent service sector in India.

The two- day seminar had five sessions: an inaugural session and four technical sessions .150 delegates participated in the seminar .

The seminar had five technical sessions.

(i) Leanings and Policy Making in the Insurance Sector

(ii) Rejuvenation of Insurance Sector – Post Covid 19 Pandemic.

(iii) Role of Insurance in Economy and Commerce

(iv) Takaful – An Alternative to Conventional Finance

(v) The Liberalism of the Insurance Sector and Impact on the Economy

Registration for the seminar started on time by 9 AM. Dr. Shaniba M.H, HoD, Dept. of Economics, extended a warm welcome. Mr. K.P Alexander, Chief Regional Manager, United India Insurance Company, Kochi Region, inaugurated the seminar. Dr. Junaid Rahman Manager, Al Ameen College, Mr. E.P Joy, Council Member, Insurance Institute of India, Mumbai, Dr. A.B Aliyar Administrative Officer (Rtd), United India Insurance Company, Dr. Leena Varghese , IQAC Coordinator, Al Ameen College were also present on the occasion.

Technical session I

The first session of the seminar started with a presentation by Dr. D.Dhanuraj, Chairman, Centre for Policy Research, on the topic “Leanings and the Policy Making in the Insurance Sector”. The topic was elaborated in detail discussing problems faced by the industry in post pandemic period. Prof. N. Kala has delivered the welcome speech. The presentation was simple and informative for the participants.

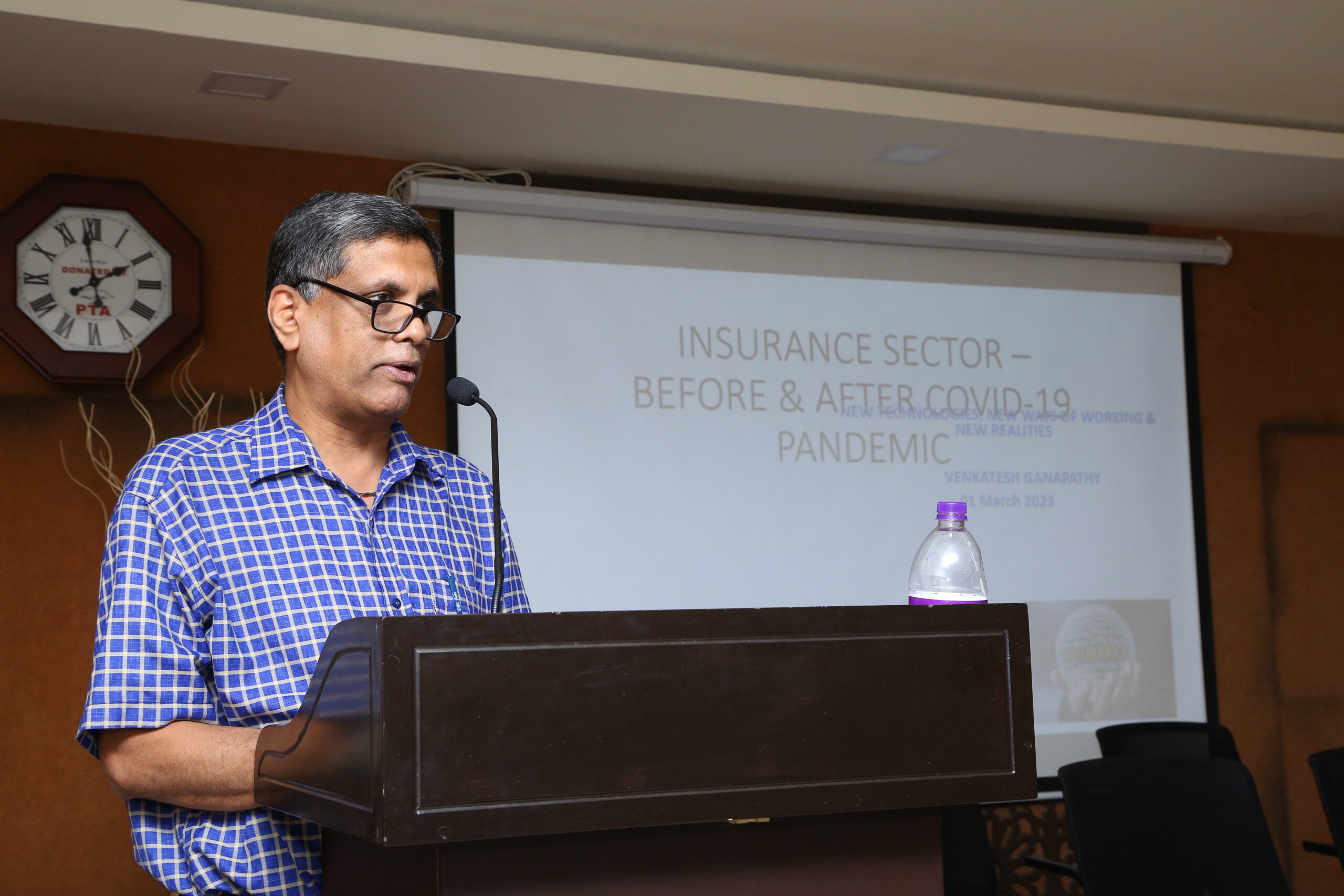

Technical session II

The second session was on Rejuvenation of Insurance Sector – Post Covid-19 Pandemic. The speaker was Venkatesh Ganapathy, Visiting Faculty, ITM, Mumbai. Dr.Abdul Hakkeem welcomed the gathering. He went into detail about the role and present scenario of the Indian Insurance Industry. He suggested that India has to go long in increasing insurance penetration.

Day 2

Technical Session III

The session began at 10 am. The resource person Dr.C Unnikrishnan Nair, Head, Maritime Logistics, Logistic Skill Council of India has made a presentation on the role of Insurance in Economy and Commerce. He explained the different roles played by the fast developing sector in our economy.

Technical Session IV

Dr. A.B Aliyar, Administrative Officer (Rtd) United India Insurance Company was the speaker on the session Takaful – An Alternative to Conventional Insurance. He presented the topic as an alternative to traditional insurance mechanisms. He narrated the successful story of some developed countries in this area.

Technical Session V

The final technical session was on the topic “The Liberalism of the Insurance Sector and Impact on the Economy”. Dr. R. Pradeep Kumar is an expert in this topic and presented it simply and productively. The presentation was very interactive.

The valedictory session

The valedictory session began at 3 pm. Dr.Abdul Hakkeem P M, Convener, Organizing Committee proposed the vote of thanks. He expressed sincere thanks to the Insurance Institute of India for their wholehearted support, the management, and participants from other colleges. It was the teamwork and team spirit that marked the success of the seminar.