The insurance sector plays a vital role in the economic development of India. It acts as a mobilization of savings, financial intermediary, investment activities, risk manager and stabilizer of financial markets. The insurance sector in India has come into a full circle from being an open competitive market to nationalization and back to a liberalized market. The Insurance sector reforms started with the incorporation of IRDA again in 2000.

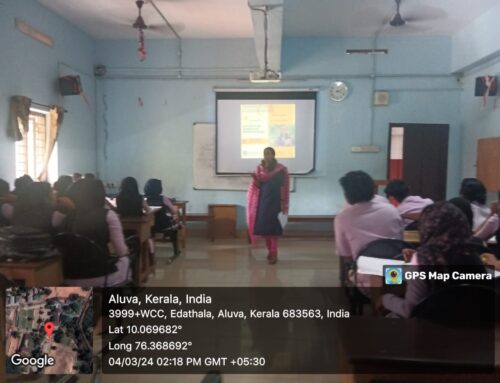

An orientation class on the Reforms in Insurance sector was organized for the first-year students of the Dept of Commerce on 03.09.19 with the objective of providing deeper insights about this sector as they could get acquainted with these principles to get across with their semester exams. Speaking about the transition of the insurance industry in India from a public monopoly to a highly competitive environment, the resource person of the day,Mr.Joy E.P. FIII talked about a number of challenges not only to the new players in this sector but also to its customer.

The resource person expressed confidence about the country’s insurance and said it would grow strongly on the back of robust GDP growth and evolving regulations.

The technical session which began in the afternoon proved to be beneficial to the students. The concluding remarks of the students were able to comprehend the concept that “Liberalisation of the reinsurance sector — with the admission of foreign re-insurers since 2017 and IRDAI’s steps to ensure that they can compete with incumbents — will specifically benefit the non-life sector.

Leave A Comment